Running a business is a thrilling journey, but it’s not without risks—accidents, lawsuits, or unexpected disasters can strike anytime. Understanding the 5 essential reasons why your business needs insurance can protect your hard work and keep your finances secure. You don’t need to be a risk expert or drown in paperwork—insurance offers peace of mind with straightforward benefits. In this detailed guide, we’ll break down these five critical reasons and show you how to budget for coverage affordably. Ready to safeguard your business? Let’s dive into why insurance is a must-have for your success!

What Is Business Insurance?

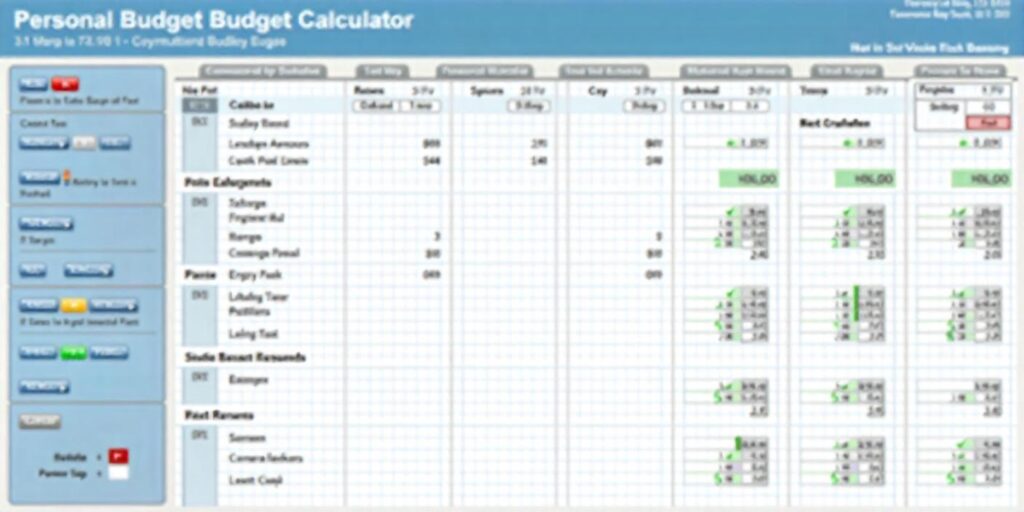

Before exploring the 5 essential reasons why your business needs insurance, let’s define it. Business insurance is a set of policies that protect your company from financial losses due to events like property damage, liability claims, or employee injuries. It’s tailored to your industry—retail, freelance, or construction—and scales with your size. While CalcMyBudget doesn’t sell insurance, its Personal Budget Calculator helps you plan for it—a free business insurance budget planner to fit premiums into your cash flow. Perfect for those seeking affordable business insurance solutions or why small businesses need insurance, it ties protection to practicality.

The core of business insurance is risk management—shielding your livelihood from the unexpected.

The 5 Essential Reasons Why Your Business Needs Insurance

Here are the top five reasons insurance is non-negotiable for your business, with insights on budgeting for each:

1. Protects Against Property Damage

Fires, floods, or theft can ruin your office, equipment, or inventory—costing thousands to replace. Insurance covers repairs or replacements, so you’re not starting from scratch.

- Example: A $10,000 equipment loss—covered vs. out-of-pocket.

- Budget Tip: Use CalcMyBudget’s Personal Budget Calculator—$50/month premium fits a $2,000 monthly budget after $1,800 expenses.

2. Shields from Liability Claims

A customer slips in your store or a client sues over a service error—legal fees and settlements can drain your funds. Liability insurance handles claims, keeping your business afloat.

- Example: $20,000 lawsuit—insurance pays vs. your savings.

- Budget Tip: Plan $75/month—CalcMyBudget shows it’s 3% of a $2,500 revenue stream.

3. Covers Employee Injuries

If a worker gets hurt on the job, workers’ compensation insurance pays medical bills and lost wages—required in most states. It’s a safety net for them and you.

- Example: $5,000 medical claim—covered vs. fined for no insurance.

- Budget Tip: $100/month fits a $3,000 budget—use CalcMyBudget to adjust.

4. Ensures Business Continuity

Natural disasters or pandemics can halt operations—business interruption insurance replaces lost income, helping you reopen.

- Example: $15,000 lost sales—covered vs. closure risk.

- Budget Tip: $60/month premium—CalcMyBudget keeps it manageable.

5. Builds Customer Trust

Clients and partners often require proof of insurance—having it shows professionalism and reliability, winning contracts over uninsured competitors.

- Example: Land a $50,000 deal—insurance seals it.

- Budget Tip: $80/month—CalcMyBudget proves it’s worth the investment.

These 5 essential reasons why your business needs insurance highlight its role as a safety net and growth tool—budgeting makes it doable.

Why Budgeting Matters for Business Insurance

Insurance isn’t free, but it’s affordable with planning. Here’s why budgeting ties into the 5 essential reasons why your business needs insurance:

- Cost Control: Premiums ($50-$100/month) beat $10,000+ losses.

- Cash Flow: Spread costs—$600/year vs. $600 lump sum.

- Prioritization: Fit insurance into rent, payroll—CalcMyBudget helps.

Using CalcMyBudget’s Personal Budget Calculator, a $75/month policy on a $2,500 revenue leaves $1,675 after $800 expenses—proving small business insurance benefits are within reach.

Step-by-Step: How to Get Business Insurance

Here’s a guide to securing insurance and budgeting for it:

- Assess Your Risks

Retail? Property + liability. Freelance? Professional errors. Know your needs. - Set a Budget

Aim for $50-$100/month—test with CalcMyBudget. - Research Providers

Options:- State Farm: $60/month liability.

- Progressive: $75/month combo.

- Local Agents: Custom quotes.

- Compare Policies

$500 deductible vs. $1,000—lower premiums save $20/month. - Apply and Pay

Online or agent—monthly vs. annual—start small, scale up. - Track Costs

CalcMyBudget shows $75 fits a $2,000 budget after $1,800 expenses—adjust if revenue dips.

These steps make the 5 essential reasons why your business needs insurance actionable, blending protection with affordability.

Benefits of Business Insurance

Beyond the five reasons, here’s what you gain:

- Peace of Mind: Sleep easy—$10,000 loss won’t sink you.

- Legal Compliance: Workers’ comp avoids fines—$1,000+ in some states.

- Growth Edge: Insured businesses win bigger clients—$50,000 contracts.

- Savings: Premiums beat out-of-pocket disasters—$75 vs. $20,000.

CalcMyBudget’s Personal Budget Calculator is a free business insurance budget planner, helping you plan $75/month vs. $100 at-risk costs—ideal for affordable business insurance solutions.

Tips to Optimize Business Insurance Costs

Stretch your coverage dollars with these tips:

- Bundle Policies: Liability + property—$100 vs. $120 separate.

- Raise Deductibles: $1,000 vs. $500—cuts $15/month.

- Shop Annually: Switch for $60 vs. $80—saves $240/year.

- Pay Upfront: Annual $720 vs. $75×12 ($900)—saves $180.

- Reduce Risks: Safety training—lower claims, lower rates.

- Start Small: Basic $50/month—add as revenue grows.

These tips pair with a why small businesses need insurance planner like CalcMyBudget’s tool, keeping costs low and coverage high.

Pair It with Business and Everyday Budgeting

Insurance fits your broader finances. For business expenses—like rent or marketing—use the Personal Budget Calculator to balance premiums with operations. For savings to cover deductibles—like a $1,000 claim—pair it with the Emergency Fund Calculator. Combining these free budgeting tools online ensures your insurance aligns with your goals—not strains them.

Avoid Common Business Insurance Mistakes

Even with the five reasons, pitfalls can cost you. Watch out for:

- Underinsuring: $10,000 coverage for $50,000 assets—gap kills savings.

- Skipping Coverage: No liability—$20,000 lawsuit wipes you out.

- No Budget Plan: $100/month strains $2,000 revenue—use CalcMyBudget.

- Ignoring Renewals: Rates jump $20—shop early.

A small business insurance benefits planner like CalcMyBudget’s tool helps you avoid these, keeping protection solid.

Practical Examples of Business Insurance Costs

Let’s see it in action:

- Freelancer: $50/month liability = $600/year—covers $10,000 claims.

- Retail Shop: $75/month combo = $900/year—$20,000 property + liability.

- Contractor: $100/month full = $1,200/year—$50,000 equipment + workers’ comp.

These examples tie to the 5 essential reasons why your business needs insurance—use CalcMyBudget to plan yours.

Enhancing Your Business Insurance Plan

Take it further with these ideas:

- Spreadsheets: Pair Google Sheets—e.g.,

=SUM(premiums*12). - Risk Tools: Use OSHA guides with CalcMyBudget for safety savings.

- Savings Plan: Divide $900/year by 12—$75/month to prep.

The Personal Budget Calculator is an affordable business insurance planner that integrates these—“5 essential reasons” made practical.

How to Budget for Business Insurance

Fund your coverage with these steps:

- Cut Extras: Skip $20/week ads—$80/month for insurance.

- Side Hustles: Consult for $50/week—$200/month covers $100 premium.

- Reinvest Profits: $75 from sales—pays itself.

- Automate Savings: Set $25/month—$300/year for basics.

Pair these with your why small businesses need insurance planner—CalcMyBudget tracks it all.

Start Protecting Your Business Today

You don’t need to risk it all—just a smart insurance plan. The 5 essential reasons why your business needs insurance shield your assets, boost trust, and ensure survival. CalcMyBudget’s Personal Budget Calculator is free, fast, and perfect for planning—no fees, no stress. Pair it with the Emergency Fund Calculator for a full strategy. Start today and secure affordable business insurance solutions with confidence—your business deserves it!